CostCertified now offers contractors the option of collecting payments from their clients directly through the system when they invoice a project. This guide will break down the payment fees and explain how to enable this option in your account. You must be at least 25% owner of the company or an executive of the company in order to be approved. If you do not meet these qualifications, then you must have a qualified user setup the account. Otherwise your payment system will be disabled.

Processing Fees

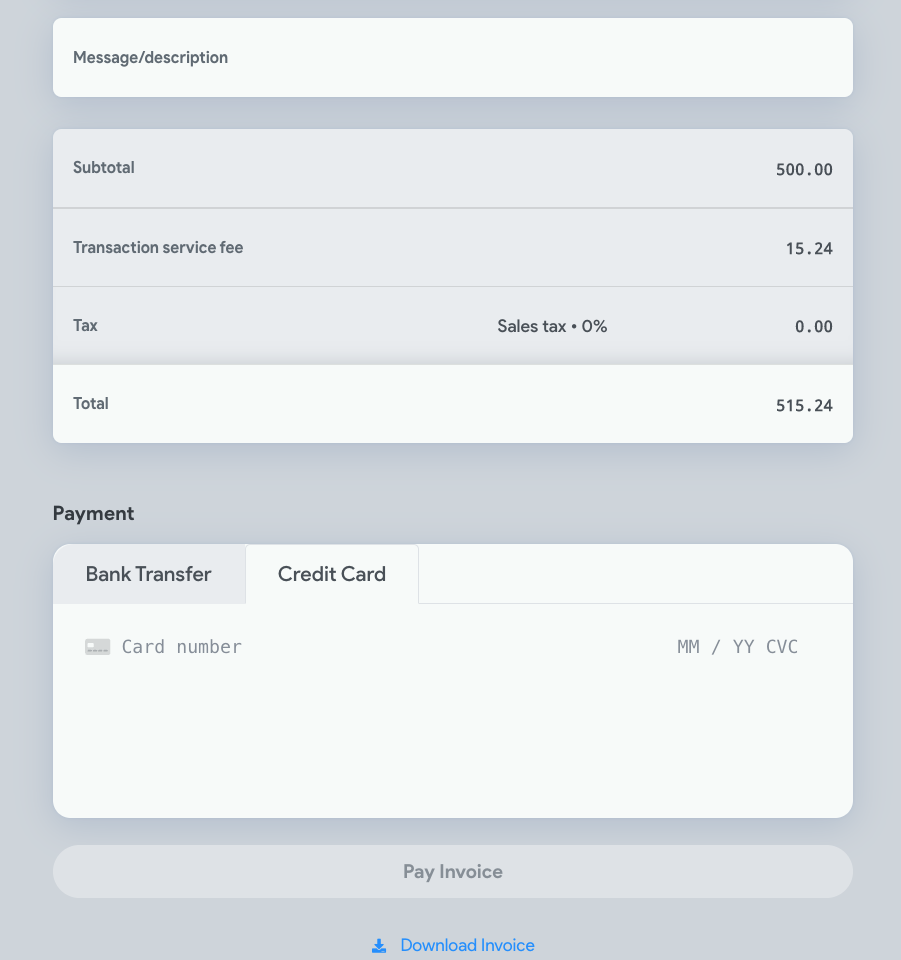

If the client chooses to pay with a credit card, the system will automatically add a standard credit card fee of 2.9% to their invoice total. This fee comes from the credit card companies, and is automatically passed on to the client by default (the contractor can decide to cover this fee when they create the invoice). NOTE: the credit card fee is charged on the total price including sales tax.

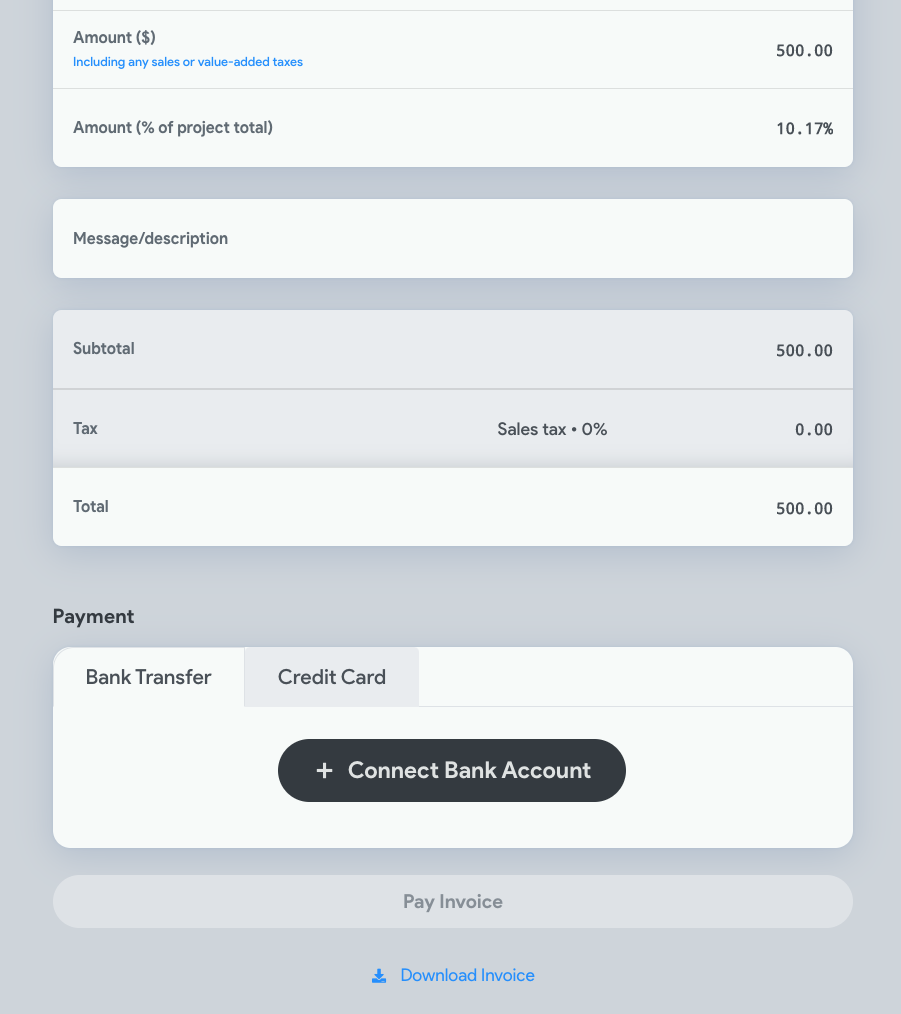

If the client chooses to pay with a bank transfer, it will prompt them to connect a bank account.

CostCertified collects 0.7% processing fee on all transactions (this is charged on the original total price, before the 2.9% is added if a credit card is used).

On a $30,000 project, this would result in a total of $210 in transaction fees to the contractor.

There is an option to cover these fees this fee or pass them onto your client when you generate the invoice.

If you would like to capture these costs without showing them on the client’s invoice, you will need to either add a fee item to the proposal, or adjust the overall profit margin.

NOTE: If you add a 0.7% fee item to the proposal, you will still pay a slight amount as the contractor. For a $30,000 job, the client would pay an additional $210, so you would pay $211.47 on the new total of $30,210

If you would like the client to pay slightly more than your final transaction fee, you can add a fee item of 0.71% to the proposal. This would make the client price $30,213 and your fee $211.4

Connecting your bank account.

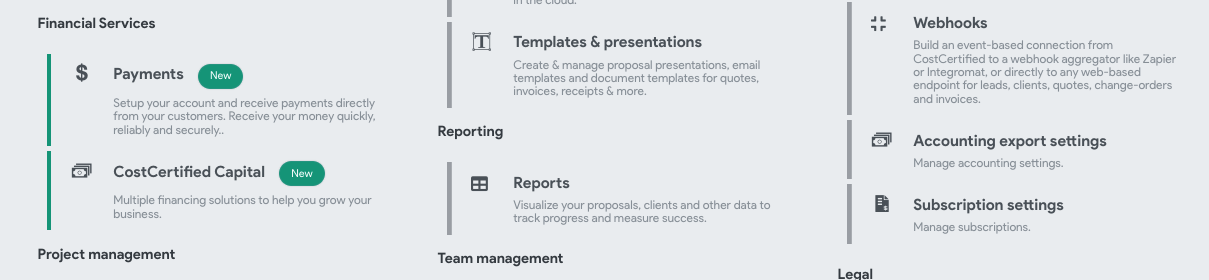

Click on the menu button (Rubik’s Cube in the top left corner), and go to the “Payments” option towards the bottom left.

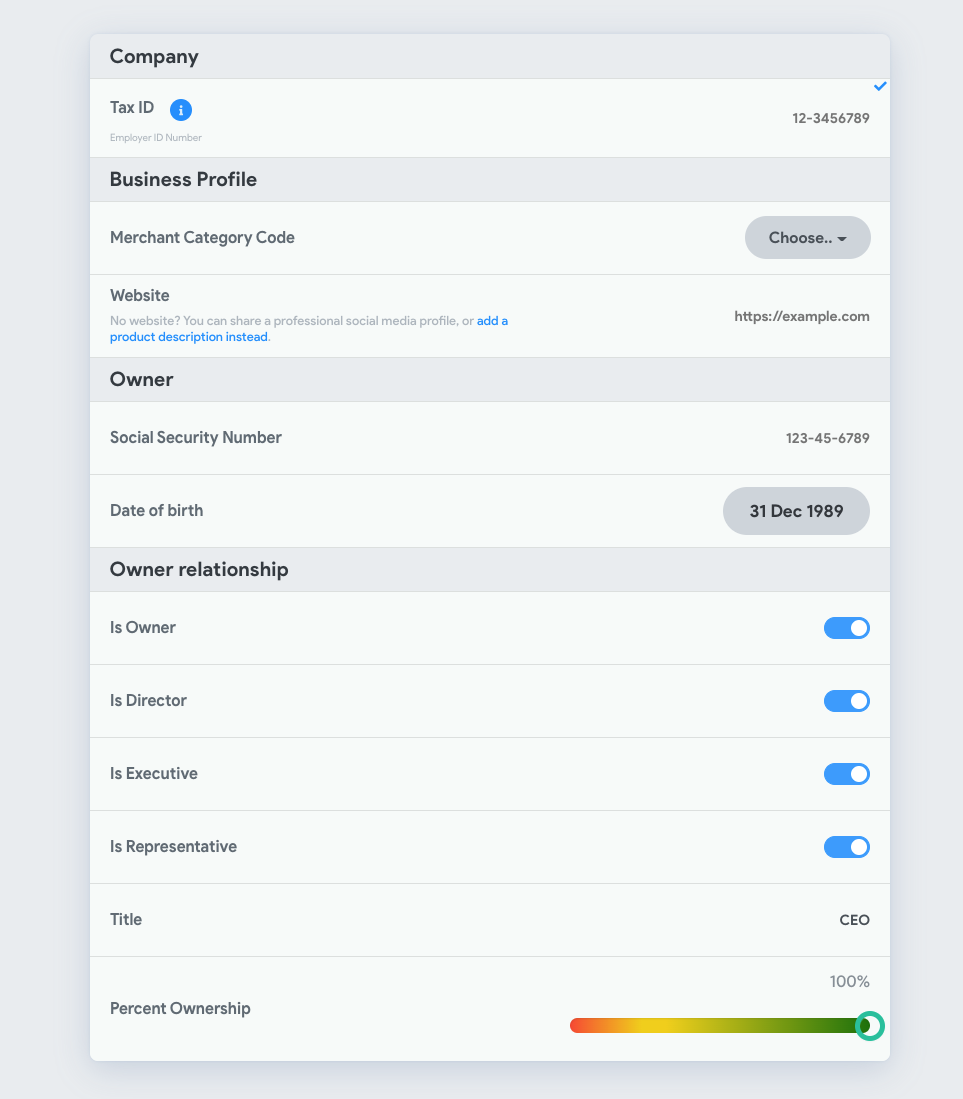

This will take you to a screen to fill out all of your company details, including the business Tax ID and your Social Security number.

These numbers are not stored in the system. They are only used to verify your business status.

NOTE: It is very important that all of your information is correct. If anything is entered incorrectly (including your address), the system will not be able to verify your account.

You must be at least 25% owner of the company or an executive of the company in order to be approved. If you do not meet these qualifications, then you must have a qualified user setup the account. Otherwise your payment system will be disabled.

After you have completed this form, you can click “Next.”

This will take you to a screen to connect your bank account using Plaid.

Plaid will take you through their process of verifying your bank account.

This typically involves them sending a few amounts of less than $1 to your account and asking you to verify the amounts.

Once Plaid has verified your bank account, you will be able to start collecting payments from your clients. The money will be deposited directly into your bank account.

Transferring into you bank account.

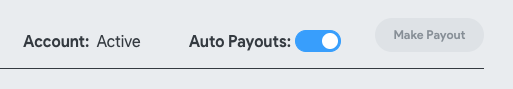

Once a payment has been collected and processed, it will go into your CostCertifed wallet. You can set the system to make Auto Payouts every night (it will automatically payout your full wallet balance every night), or you can turn that option off and manually set your payout amounts.

In the United States, the money will be transferred in 2 business days.

In Canada, it will be transferred in 3 business days.

The credit card transaction fee and the 0.7% processing fee will automatically be deducted from the invoice total unless you passed them on to your client.

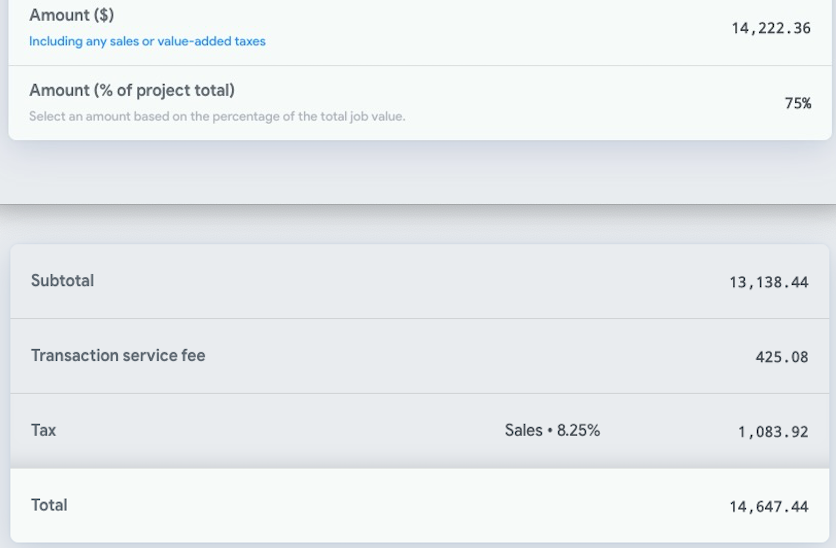

In the example above, the contractor sent an invoice for $14,222.36

This amount was charged as $13,138.44 with 8.25% sales ($1,083.92) added.

The 2.99% credit card fee is charged on the $14,222.36 and the client pays a total of $14,647.44

NOTE: The system is actually calculating the fee using additional decimal points (2.98857etc) so the exact dollar amount may vary slightly if you check it with a calculator.

The system also collects the 0.7% processing fee on the original $14,222.36 for a fee of $99.56

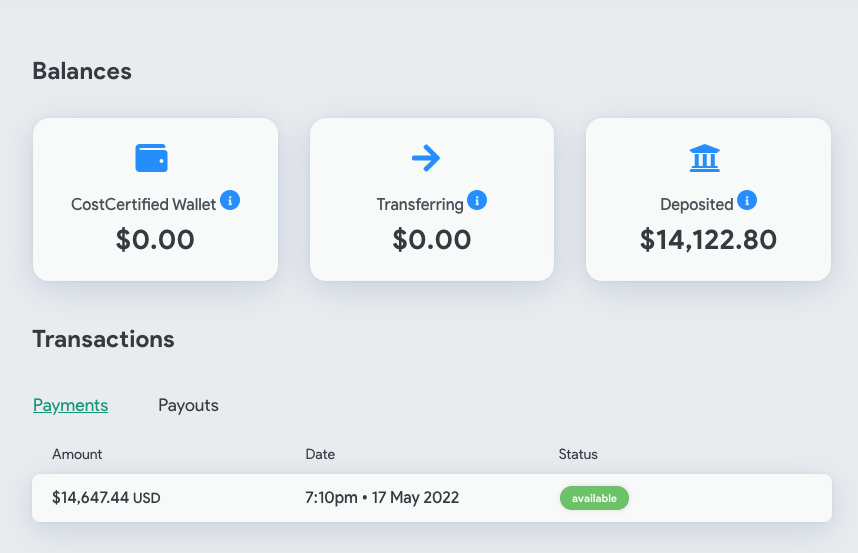

Once the payment is collected, the system removes the credit card fee and the 0.7% processing fee before depositing the payment into the contractor’s wallet.

$14,222.36 - $425.08 (credit card) - $99.56 (processing fee) = $14,122.80